top of page

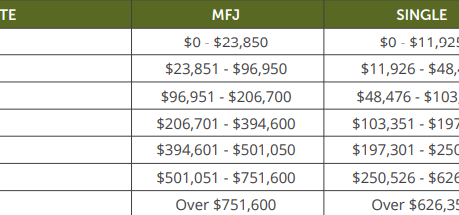

2026 Federal Tax Brackets and Key Contribution Limits

Key 2026 IRS Federal Tax Brackets and Contribution to 401k, 403b, 457 Plans are summarized here. Download the PDF for full details.

SRIDHAR KRISHNAN, CFP®, MBA

Nov 27, 20251 min read

Top 5 Things To Do Now!

Here are five things you should at the beginning of the year in addition to filing for taxes before April 15.

SRIDHAR KRISHNAN, CFP®, MBA

Mar 17, 20254 min read

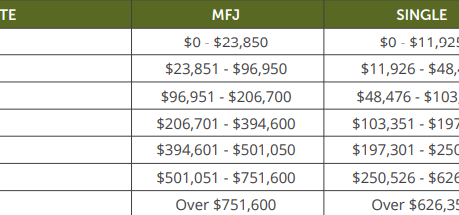

2025 Federal Tax Brackets and Key Contribution Changes (July 2025)

Key 2025 IRS Federal Tax Brackets and Contribution to 401k, 403b, 457 Plans are summarized here. Download the PDF for full details.

SRIDHAR KRISHNAN, CFP®, MBA

Nov 26, 20241 min read

bottom of page